UK borrowing costs climb as City braces for the budget

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

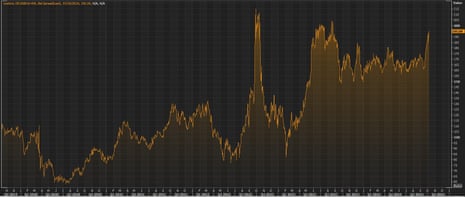

UK borrowing costs have been climbing in recent days as investors have braced for the budget in a little over three weekâs time.

Traders have been selling UK bonds, known as gilts, which pushes up the yield (or date of return) on the debt.

As a result, the gap between UK and German borrowing costs has now reached its widest since summer 2023, and is appproaching the levels seen during the mini-budget panic of 2022â¦. as this chart shows:

The yield on 10-year UK government gilts has now risen to 4.2%, its highest level since the general election three months ago.

Notably, thatâs higher than the US â which pays around 4% to borrow for a decade â as well as Germany, where 10-year bunds yield just 2.2%.

Rising borrowing costs reduce the amount of headroom the government has to tweak tax and spending plans while still meeting its fiscal rules â to have debt falling in five-years time, and to balance day-to-day expenditure with tax receipts.

The City is anticipating that chancellor Rachel Reeves may adjust the UKâs fiscal rules, to give herself more headroom to fund investment projects. Such a move could lead to higher government borrowing than expected

Reeves must decide by Wednesday whether to do this, and potentially unlock up to £57bn in additional spending on infrastructure at this monthâs budget.

Kathleen Brooks, research director at XTB, says âspeculation is risingâ that Reeves could change how the governmentâs fiscal rules are calculated to allow more spending on housing, roads and hospitals.

She explains:

The Labour government has promised that it would follow the Conservativeâs fiscal rule, that public sector net debt should be falling in the fifth year of a forecast period. One way that the Chancellor could achieve this fiscal target at the same time as boosting investment, is to exclude losses on the Bank of Englandâs stock of bonds accumulated during quantitative easing from the governmentâs balance sheet. This could give the Chancellor up to £15bn of fiscal headroom.

Other plans being discussed include moving a national wealth fund away from the governmentâs books, which may also add another £15bn to the Chancellorâs fiscal headroom. The government is looking at ways to publish estimates of how much new capital projects will boost growth and generate money directly for the Treasury, which could also take the focus away from capital spending.

The agenda

-

7am BST: Gerrman industrial production data for August

-

8am BST: Kantar grocery inflation data for September

-

1.55pm BST: Redbook index of US retail sales

Key events

Feargal Sharkey unimpressed with Ofwat

Water campaigner Feargal Sharkey says Ofwat should recognise that this yearâs performance report shows the âsheer incompetenceâ of the regulator:

Of course what it should have said is

“This year’s performance report is yet another start reminder of the sheer incompetence of Ofwat, an organisation that I run, and highlights once more that for the last 35 years we have failed both customers and the environment.

It is true⦠https://t.co/nfNzXT8Jyz

— Feargal Sharkey (@Feargal_Sharkey) October 8, 2024

Ofwat unimpressed with weather excuses

Looking back at Ofwatâs Water company performance report for 2023-24 (see 7.19am onwards)â¦. the regulator is not impressed that water providers are keen to blame the weather for their failings.

Ofwat says it expects companies to manage the impact of weather by maintaining their assets so they can meet their statutory requirements.

Ofwat chief executive David Black says:

It is clear that companies need to change and that has to start with addressing issues of culture and leadership.

Too often we hear that weather, third parties or external factors are to blame for shortcomings. Some fail to demonstrate a good understanding of the root causes of issues and it is also unclear the degree to which Boards and Executives are championing change and improvements.

FTSE 100 slumps on China stimulus disappointment

Disappointment that China did not roll out more stimulus measures today have hit the London stock market too.

The FTSE 100 share index has hit its lowest level in over three weeks this morning. Itâss currently down 110 points, or 1.3%, at 8,193 points

While troubled Vistry remains the top faller (-29%), itâs followed by several mining companies. Copper producer Antofagasta are down 6%, Anglo American have lost 5.5% and Rio Tinto is off 4.7%.

Asia-Pacific focused Prudential (-5.8%) are also in the fallers.

Russ Mould, investment director at AJ Bell, explains:

Metal producers have been keeping their fingers crossed for stronger demand from China following a miserable time for industrial commodity prices of late.

However, the negative share price performance of Antofagasta, Rio Tinto and Anglo American would imply that Chinaâs latest economic stimulus measures might not live up to the initial hype. Or it might simply be canny investors locking in some of the recent gains on the stocks just in case we see a broader pullback.

Itâs been a turbulent time in Chinaâs stock markets today, as trading resumed after a one-week holiday.

Stocks initially surged, as traders returned to their desks after the âGolden Weekâ breaking, hoping for more stumulus measures from Beijing.

The CSI 300 Index, which tracks the biggest companies in Shanghai and Shenzhen, jumped by over 10% in early trading.

But the rally subsided after a highly-anticipated press conference by Chinaâs National Development and Reform Commission disappointed those hoping for more stimulus action.

NDRC chairman Zheng Shanjie did pledge a raft of steps to bolster the countryâs economy, but he didnât announce any new major stimulus plans on top of the measures announced in September.

That knocked the mood, with the CSI 300 index closing almost 6% higher.

Hong Kongâs Hang Seng index, which rallied last week while the CSI 300 was closed, sank by 9.4% today.

ð¨HONG KONG STOCKS HAVE BEEN COMPLETELY SMASHED ON TUESDAY AS CHINA’S RALLY FADESð¨

The Hang Seng index FELL 9.4% on Tuesday erasing 1/3 of the last 3 weeks’ gains.

The CSI 300 index ended +4.6% but 4.3% below its daily high as the Chinese market gapped up after the holiday. pic.twitter.com/EVFKIen400

— Global Markets Investor (@GlobalMktObserv) October 8, 2024

Last month, Chinese policymakers announced a swathe of monetary stimulus measures to support borrowing and stimulate its property sector.

Stephen Innes, managing partner at SPI Asset Management, says Beijingâs reluctance to roll out a bigger stimulus package is âraising serious doubtsâ about the sustainability of the rally.

Innes says:

After what was hyped as the âmother of all catch-up bounces,â Chinaâs markets rally has hit a wall, leaving investors deflated.

The reopening surge from the week-long holiday barely had time to gather steam before fizzling out, and now the once-thrilled bulls are licking their wounds. With fresh stimulus nowhere in sight, the rally has stalled, and the euphoric âDragon Boatâ ride has taken a sharp U-turn.

Senior reveals job cuts in face of Boeing strike and Airbus problems

UK engineering firm and aerospace parts maker Senior is cutting jobs and furloughing staff after being hit by the ongoing strike at Boeing.

Senior makes high-tech components for aerospace, defence, land vehicle, power and energy companies. It told shareholders this morning that the commercial aerospace manufacturing industry is facing âtemporary but significant headwindsâ, which are hitting demand for its products.

One headwind comes from Boeing, where workers have been on strike for more than three weeks. Senior says this has had âan inevitable impact on our operating businesses most exposed to this customerâ, both directly and through other suppliers.

In addition, Airbus has also suffered supply chain challenges, which have led to production delays.

Senior has recently been told that one of Airbusâs suppliers will âsignificantly reduce scheduled deliveries from Seniorâ in the last quarter of this year, before returning to normal during the second quarter of 2025.

In response, Senior is âaligningâ its headcout through temporary furloughs and permanent headcount reductions, cutting discretionary spending, rescheduling delivers of materials to meet future demand, and postponing uncommitted capital expenditure

It says:

While the full impact on our businesses exposed to the affected programmes is not yet certain, we have moved decisively to contain costs and preserve cash.

Shares in Senior are down 13%, to the bottom of the FTSE 250 index of medium-sized companies.

China hits out at EU brandy in tit-for-tat after EV tariff vote

China has annoucned temporary anti-dumping measures on brandy imports from the European Union, in retaliation for tariffs on Chinese-made electric cars.

An investigation has preliminarily determined that dumping of brandy from the EU is threatening to cause âsubstantial damageâ to Chinaâs own brandy sector, the Chinese commerce ministry said.

From 11 October, Chinese importers of brandy originating in the EU will have to put down security deposits mostly ranging from 34.8% to 39.0% of the import value, the ministry said.

China has found that European brandy has been sold in China below market prices.

The move come four days after EU leaders gave the green light to extra tariffs on electric vehicles from China, of up to 35.3%, on top of existing duties of 10%.

Todayâs news has hit French sprits makers â Remy Cointreauâs shares have tumbled 8%, Pernod Ricard are down 4%, while LVMH â which makes Hennessy cognac â have lost 4.3%.

Beijing also hinted that it could take further retaliatory measures, Reuters reports:

The Chinese ministry said its anti-dumping and anti-subsidy investigation into EU pork products was ongoing and would make âobjective and fairâ decisions at the end of the probe.

The ministry added that it was considering a hike in tariffs on imports of large-engine vehicles. Higher levies would hit Germanyâs producers the hardest, with German exports of vehicles with engines of 2.5 litres or larger to China reaching $1.2 billion last year.

HS2 likely to reach Euston, minister suggests

Transport Secretary Louise Haigh has indicated that the HS2 train line is likely to reach Euston, saying it âwould never have made senseâ for that not to happen.

Haigh has said an announcement on the project will be made âsoonâ, and could happen around the time of the Budget on October 30.

Asked by Times Radio on Tuesday if it is affordable for HS2 to reach Euston, rather than terminate five miles west of central London at Old Oak Common, Haigh replied:

âWe will be making an announcement on that soon.

âBut it certainly would never have made sense to leave it between Old Oak Common and Birmingham.â

Asked if the announcement may come in the Budget, she said:

âIt may be made around those decisions.â

The question of whether HS2 would reach Euston has been up in the air since last October, when prime minister Rishi Sunak announced that private investment would be needed to extend HS2 from Old Oak Common, in the suburbs of west London, to Euston.

This was aimed at saving £6.5bn of taxpayersâ money, with Sunak also scrapping the northern leg of HS2.

Haighâs comments come after rail industry leaders told the government that building HS2 all the way to London Euston and Crewe could save the government money by enabling it to lease the line out for much more.

The High Speed Rail Group (HSRG) is proposing selling the rights to run the line as a long-term concession â on a similar basis to the HS1 rail route linking the capital to the Channel tunnel.

HSRGâs analysis shows that such a concession would be worth about £20bn if fully developed from central London and joining lines to northern cities, but just a fraction of that under current plans to terminate at Old Oak Common and Birmingham.

Shares in housebuilder Vistry plunge after profit warning shock

Ouch! Shares in UK housebuilder Vistry have plunged by a third this morning, after it admitted that costs have been running higher than expected at several of its building sites.

It has warned shareholders that its cost projections for nine developments in the South East have been understated by around 10% of the total build costs.

This means that Vistryâs adjusted pre-tax profits this year will be around £80m lower than expected, at £350m.

Vistry says, ominously, that âchangesâ are afoot at the offending division:

We believe the issues are confined to the South Division and changes to the management team in the division are underway. We are commencing an independent review to fully ascertain the causes.

Traders have driven Vistryâs shares down to the bottom of the FTSE 100 index; theyâre off by 31% at 882p.

Thames Water will pay the largest penalty out of all the water companies regulated by Ofwat.

Out of the £157.6m total of penalties for poor performance, Thames must pay £56.8m.

Second is Anglian Water, with a fine of £38.1m, followed by Yorkshire Water with £36m.

UK grocery inflation rises to 2%

In the supermarket sector, grocery inflation has edged up again, data provider Kantar has reported.

Supermarket prices are now 2% more expensive than a year ago, up from Augustâs 1.7%, according to Kantar.

Price rises drove shoppers towards discounts â sales of promoted items jumped by 7.4% over the month while full price sales rose by just 0.3%.

Fraser McKevitt, head of retail and consumer insight at Kantar, says:

âIn the fiercely competitive retail sector, the battle for value is on.

âSupermarkets are doing what they can to keep costs down for consumers and thanks to their efforts the prices in some categories are falling.â